Creative ways to save on your Wedding Day!

You’re newly engaged—congrats! And now, before you set foot in a venue or dress shop, it’s time to figure out what you can afford.

Many big days come with a big budget, but the truth is, you don’t have to break the bank to have the wedding of your dreams. What’s important, though, is to have some key financial conversations before you dive into the spending cyclone that a wedding creates. Here’s how to set (and stick to) your budgeting priorities:

Start as a Couple

An important first step is talking about your expectations for the wedding with your fiancé(e). If you haven’t talked a lot about weddings before you got engaged, you each might be surprised about what you want. Do you envision a large, formal wedding, or a small, intimate one? Will it be local or destination? How many attendants will make up the wedding party? Talk about what your priorities are before you start budgeting—as all of these decisions will affect your bottom line.

Then, decide as a couple how you want to pay for the wedding. Do you want to use your savings to cover it yourselves? Can you enlist the financial help of your families? Do you want to?

This is also a good time to discuss financial matters and expectations more generally. Money can be an emotional topic and can affect your relationship as you move toward marriage, so spend time thinking and talking about the ideas you’ve attached to it. Also consider how your parents discuss money—your fiancé likely learned his money behavior from his parents (and you from yours). Besides, once you understand how each of your families discusses money, it will be easier to communicate with them on the budget.

Inviting Others to the Conversation

Traditional wedding etiquette dictates that the groom (or his parents) plan and pay for the rehearsal dinner, rings for the bride, the honeymoon, the groom’s attire, the marriage license, and the officiant fee, and the bride (or her family) provides for everything else. But today, tradition is considered more of a flexible guideline than a definitive expectation. In some cases, couples pay for the wedding themselves. In others, non-parent family members—grandparents, stepparents, aunts, uncles, family friends—contribute to the day, too.

So, your best bet is not to make any assumptions about who’s paying for what. (Keep in mind that wedding planning is prime time for feelings to get hurt.) Instead, set up a private time to meet with each set of parents to talk about your wedding, and ask how they envision being part of your big day. Hearing out each parent’s vision of the wedding will give you a better idea of where they would like to spend money and time on helping to make your day special. Ideally, a wedding will turn out to be a collaboration of ideas, money and work—exactly what the start of a new family should be!

Find a Budget Buddy

Once you’ve outlined what you and everyone else wants to contribute, you can plan your budget. Remember, it’s important to get everyone comfortable with the proposed total before vendors start pitching you their (likely expensive) version of your big day!

Then, you need what I call a “budget buddy.” There are many great apps and websites that can help you start making your budget a reality. If you have a particular number in mind but have no clue what that will get you, take a look at Jessica Bishop’s blog, The Budget Savvy Bride, to check out the stories and budgets of real brides.

After you’ve browsed some sample budgets, set up an account on The Knot or WeddingWire. Each site has a budget tracker that allows you to input your total dollar amount and see it divided up among the basic categories of a wedding budget—venue, food, décor, your attire and more. WeddingWire also allows you to keep track of who is paying for what in case you’re splitting it several ways, plus note which deposits have been made and what’s still due in each line item.

Prioritize

While these calculators are a great place to start, they divvy up expenses by the percentages the average couple spends in each category, so they may not be identical to your needs. Remember that it’s okay to splurge on what’s most important to you in your wedding, and cut back on (or forgo) other expenses altogether. And that’s why you and your fiancé(e) need to prioritize where the money should be spent.

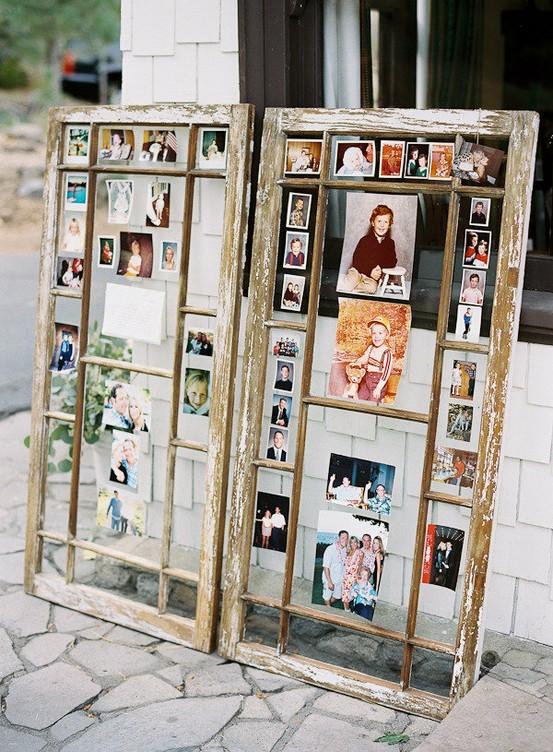

For instance, my friend Rachael and her fiancé, Bo, are foodies getting married at a vineyard in Sonoma. Spending big bucks on wine was a must for them—so they cut back the hours on photography to open up the budget. (You could consider renting a photo booth instead for friends and family to use throughout the reception!) Or, cut your expenses elsewhere by exploring non-traditional dessert options instead of a massive wedding cake.

Keep Track

Of course, even once you’ve established your budget, keeping within the guidelines takes work. When you meet with different vendors, you’re bound to be tempted by the add-ons of fancy lighting, disco balls, snazzy seat covers, and luxurious linens. But try to remember the end goal: for everyone to stay happy with the day (and the numbers). Be sure to log on to your budget tracker once a week to enter any payments that have been made or to adjust your original estimates. And if you realize that you’re going over budget, reevaluate. What’s most important—and where can you cut back?

Remember that you don’t have to go into major debt in order to create the special day you’ve always wanted. Because, at the end of that day, what matters most is the time spent celebrating two people and two families joining together.